The EdTech sector in India has been climbing the charts since the pandemic, but with the focus shifting back to offline learning, it has seen a shake-up of sorts. So where is it headed? We speak to industry

experts who share their insights.

By BINDU GOPAL RAO

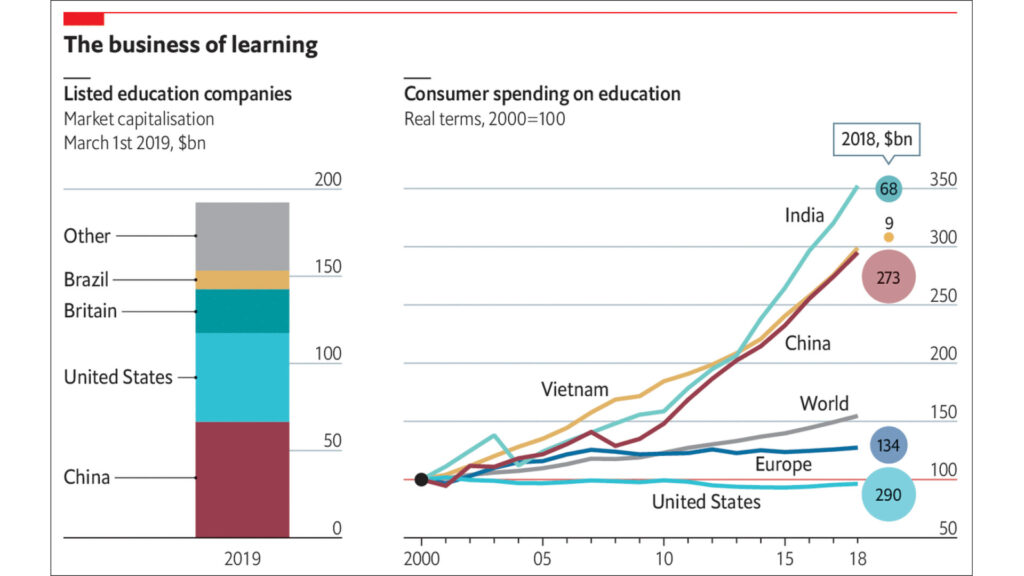

ACCORDING TO THE RECENT ʻINDIA E-Learning Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023 2028,’ report by International Market Analysis Research and Consulting Group (IMARC Group), India’s EdTech industry is on a roll! It’s growing at a compounded annual growth rate (CAGR) of 13.7 percent and is estimated to reach US$14.1 billion by 2028. Impressive numbers, for sure. However, while the future may be bright, the current scenario is not without its challenges.

It’s common knowledge that the pandemic had disrupted traditional learning and forced a shift towards online education. Now, with life returning to the new normal in India, which includes the reopening of schools, the K-12 segment is returning to its earlier o one mode of teaching. That being said, tuition and test prep centres are still looking at a hybrid model of learning delivery that involves a mix of online and online classes. While this definitely helps the EdTech sector, it’s in the realm of higher education and upskilling of working professionals that online learning really finds its thriving force.

The acceleration of digitalisation, driven by the COVID-19 pandemic, led to significant changes in job dynamics for employers and employees. Moreover, workers’ expectations have seen a great shift. With job volatility and inflation, securing a well-paying, stable job that allows long-term career advancement has become critical. As a result, many working professionals are seeking to reskill and upskill themselves to stay relevant in the job market. As a result, executive online learning has emerged as an immensely popular option. The flexibility and convenience it offers makes it easier for professionals to apply themselves to studying further, enabling them to upskill themselves without compromising their work or family commitments.

The democratisation of education is yet another factor contributing to the growth of online learning, with top universities and industry experts offering high-quality courses at costs that are much lower than those expected in traditional education.

DOING THE MATH

With over 1.5 million schools and more than 300 million students enrolled in them, India is one of the largest education systems in the world. According to an industry estimate, India currently is home to more than 4,000 EdTech start-ups. However, recent reports indicate at least 25 funded start-ups have shut down and the industry has seen over 7,000 layoffs. The sector has also been in the news for a wave of consolidations, as well as decline in funding due to a return to offline learning in schools and colleges. It is worth noting that while these recent job losses have raised concerns, they appear to be more a result of internal factors such as over-hiring, overspending, and rapid expansions rather than a lack of demand for EdTech. According to Ranjita Raman, CEO, Jaro Education, a higher-education EdTech brand, “The industry still holds great potential and promises a bright future due to the increasing demand for online education and the growing adoption of technology in the education sector. It is important to note that these layo s are not indicative of the industry’s future. In fact, the EdTech sector is expected to continue to flourish in the coming years. As technology continues to evolve and play an increasingly important role in our lives, the demand for online education and

upskilling is only going to increase.”

GOVERNMENT IMPETUS

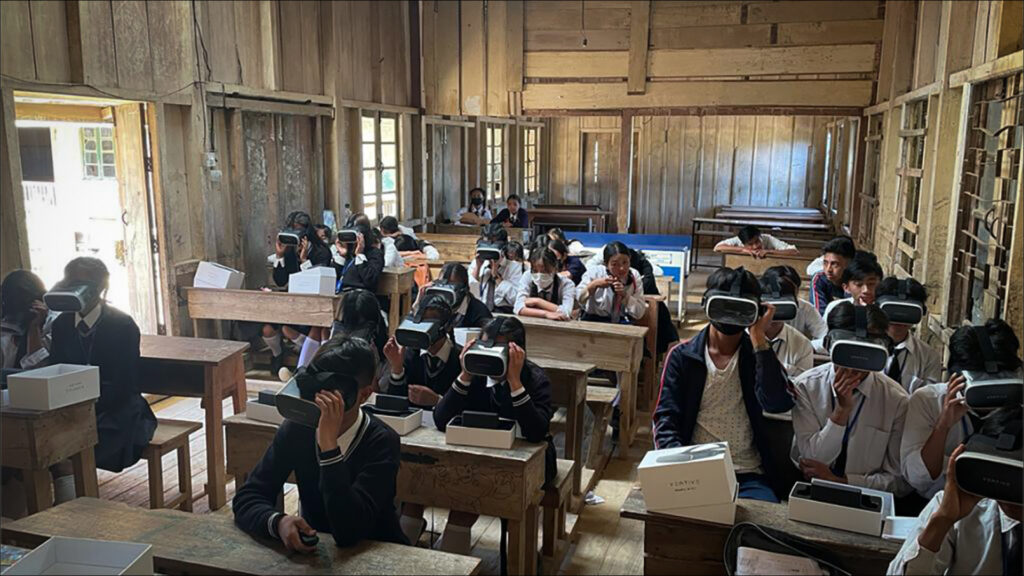

There is yet another reason why the sector should remain optimistic. And that is the massive potential awaiting in the huge, untapped rural market of India. It’s clear the government is betting big on digital learning. The Union Budget FY24 set aside `1.12 lakh crore for education with Finance Minister Nirmala Sitharaman announcing a national digital library for children and adolescents. Nishant Chawla, Co-founder and Director of Lets Unbound, a STEM.org accredited platform, says, “In rural areas, digital infrastructure is not fully developed due to the lack of availability of computers and high-speed internet connection. Education in rural areas is still a challenge. With the government’s push for digital literacy, EdTech companies can leverage this opportunity to facilitate rural EdTech expansion.” Ankur Aggarwal, CEO of Veative, an EdTech company, concurs: “As part of a government initiative ‘Sabko Shiksha, Achchi Shiksha’, we have established Virtual Reality (VR) labs in 42 government and senior secondary schools of Nagaland, one of the remotest areas of India, offering students access to an interactive VR-based education library. These cut across the challenges of inadequate physical infrastructure, poor internet connectivity, and geographical barriers taking education to the very last mile.”

Additionally, the Ministry of Education in India has incorporated Smart Classrooms and ICT (Information and Communication Technology) labs in its ICT Policy, as a central initiative to promote technology in school education. In recent years, the government has launched several digital education initiatives such as ‘Swayam’, a platform offering free online courses from top universities, and the ‘Diksha’ app, giving teachers access to digital content and resources. Many believe that partnering with the government on these initiatives can also give a fillip to EdTech players. Rajesh Panda, Founder and MD, Corporate Gurukul, a learning and development firm, says, “The measures announced by the Finance Ministry, such as creating three centres of excellence for Artificial Intelligence, 100 laboratories for the development of 5G apps, and the establishment of a national digital library will also help the development of the EdTech sector in India.” The key to success, however, lies in rebuilding trust, an issue that continues to plague the industry, and is further aggravated by a lack of effective regulation and legislation.

SHIFTING GEARS

That’s not to say that the industry is relying solely on the government to help them survive and grow. The EdTech sector has been taking its own proactive steps and is looking to make changes to remain relevant and sustainable in the long run. One such great initiative is Personalised Adaptive Learning (PAL), an innovative solution in EdTech that personalises the learning path of every student based on their current learning levels. Every chapter on PAL offers a diagnostic test to the students, identifying their learning level and suggesting supplementary learning content and practice to create a unique learning path for every student. PAL also facilitates access to learning resources of junior classes to cover the historical learning gaps of previous years, helping bring them to grade optimum learning levels. “PAL is a great innovation in EdTech,” says Puneet Goyal, Co-founder of iDream Education, which works to facilitate universal access to learning and growth. “It empowers our students to bridge their learning gaps in a personalised and non-judgemental manner. It is also a great boon for our government school students who suffer from the previous year’s learning gaps, which are hard to cover up otherwise and become a major obstacle in the learning and

growth of last mile learners.”

Other crucial changes that are making inroads are the tailor-made solutions, designed to cater to individual needs and preferences, being offered by EdTech companies. Students are now more informed while selecting what they want to learn and when they want to learn it. “As a result, the demand for flexible, on-demand learning solutions has increased, with students seeking customised content and delivery that fits their schedules and specific requirements,” says Sachin Sandhir, Founder and CEO of GENLEAP, India’s first DNA-based self-discovery and career management platform.

A PERFECT BLEND

Recognising the staying power of offline learning and, indeed, the necessity to work in cohesion, the industry has now shifted focus to a hybrid model, combining online and offline learning. For instance, in a spate of recent collaborations between prominent EdTech companies and brick-and-mortar teaching centres—BYJU’s acquired Aakash and started BYJU’s Tuition Centre; Physics Wallah created PW Pathshala; and Unacademy started Unacademy World and Unacademy Center as their o¡ ine brands.

MONEY TALKS

The proof is in the pudding, as they say. The fact that all these private and government-led initiatives and changes are making an impact is evident in the financial investments coming their way, despite the downturn. As per EdTechReview, a reputed education platform, several of these major players received massive funding in 2022: BYJU’s (U$800 million), Allen Career (US$600 million), upGrad (US$435 million), Eruditus (US$350 million), and Physics Wallah and LEAD School (US$100 million each).

Girish Singhania, CEO of EduBridge, an EdTech company, says, “Workforce development platforms and skill development platforms received handsome funds from angel investors and venture capitalists for propelling the youth from underserved parts of the country to secure placement opportunities at reputed multinationals. These consolidations bridge the technological gap and ensure that they (the companies) evolve from strength to strength.”

Essentially, the EdTech industry in India is on a sharp learning curve. It remains to be seen if they pass with flying colours!

Related: Discover The Rise And Challenges Of The Electric Vehicle (EV) Industry In India